Earlier this month, Amazon’s opening of a physical store created a fair bit of buzz online. Most observers found it puzzling. Why, after disrupting and demolishing the physical bookstore – as evidenced by the closing of Borders, and crippling of Barnes & Noble – would Amazon want to launch a physical bookstore themselves?

Now, Amazon is an extraordinary company, and its founder Jeff Bezos, is known for thinking really long-term and lateral. So clearly there is something to its decision to launch the physical store. Yet a lot of the coverage – as exemplified by this Vox story – attributed Amazon’s physical foray into an attempt to gain a slice of physical retail as well.

This in my view is a mistake. Everything Bezos does is worth examining closely. After all, This is a person who has created two extraordinary businesses – one, the amazon online store: a ruthless e-commerce machine that works at razor thin margins and creates total customer delight; the second, AWS or Amazon Web Services, often termed as “the fastest growing enterprise busines in history”, and possibly the single-most responsible factor behind the startup boom in Silicon Valley today.

So why did Bezos, and Amazon launch the store? Here is my take.

Everything that Amazon does is best viewed through the lens of online retail. This is the company that after all pioneered online retailing as we know it, and has innovated across every single point of the customer value chain (one-click shopping, its Prime services, 1-hr delivery service etc). Amazon, and Bezos, are such big believers in online commerce, and the power of the internet to transform commerce, that their headquarters are housed in a building complex called Day 1, so called because Bezos believes that it is still Day 1 of the Internet.

So why would a company that is such a fervent believer in the power of online, launch a physical store? The answer is that it would do that only if it believed that the physical store would help them sell better and more online. Why would this be? How can a physical store help Amazon sell better online? And why did Amazon start with books? Why not say jewellery or clothes, where far more touch and feel is involved?

Let us take the last question first. Books is a special category for Amazon. It is the first category they started out with, and it is possibly the category that they dominate the most and likely brings in the maximum profits for them (basis this story). Yet, it is a category where I think they have really plateaued. E-book sales aren’t growing as spectacularly as they used to, Kindle sale numbers are ‘pitiful’ apparently, and Amazon has had to finally settle for truce in its battle with Hachette.

Additionally, books are a peculiar category too in that discovery and commerce are deconstructed online, as opposed to physical bookstores where discovery is built in to the very act of purchase. People go to bookstores to explore (often they dont have a specific book in mind) and then buy. Online selling of books, on the other hand, caters to people who have clarity on what they want. You come to buy 1–2 specific books and go.

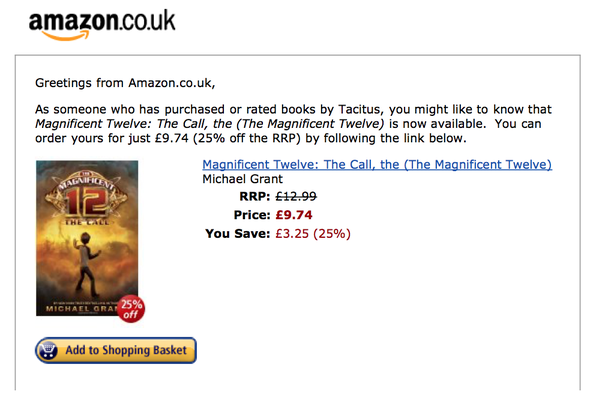

This is at heart the fundamental challenge that Amazon faces. While it wants to cater to the entire universe of book buyers, it is only serving the ones who are very clear about what they want to buy. This also correspondingly makes their recommendation algorithm weak — because it is only getting data from pre-decided buyers, not exploring buyers – and that leads to a vicious loop, making it more difficult to serve decent recommendations and getting browsing audiences to buy.

And thus, you have this (courtesy Benedict Evans)

Amazon is trying to overcome this challenge not by trying to set up a physical book-selling business – that is not in its original intent as I explained earlier – but rather by enhancing its recommendation algorithm. To do that it needs data – on customer behaviour while browsing (do customers tend more to buy books next to each other?), what factors make a difference to customer’s impulse buying (do recommendations from authors work?). Hence the decision to set up a store and use the resulting data to feed their online learning machine. This new data will enhance the recommendation engine dramatically. And clearly if you get better recommendation data online, you will end up buying more books.

Keep in mind that a lot of Amazon’s efforts are aimed at removing barriers to purchase, such as Prime, same-day delivery etc. If you could get it soon (Amazon Now) or instantly (such as with physical stores), would your online purchase change dramatically? The physical book store is a similar initiative, structured a bit differently as a parallel retail channel / experience centre, with the objective of getting discovery data to add to the machine and enhance it to sell better online.

Amazon has made efforts into generating better recommendation data previously as well. They purchased GoodReads, and a big reason for that was really to understand consumer recommendations and this whole process of how consumers buy books. And i think the way they handled the GoodReads acquisition and managed the business post acquisition gives us clues. They have kept GoodReads going as it is. I am sure the data is fed into the amazon algo machine, and there is the integration with kindle, but that apart the business runs hands off from the amazon books team.

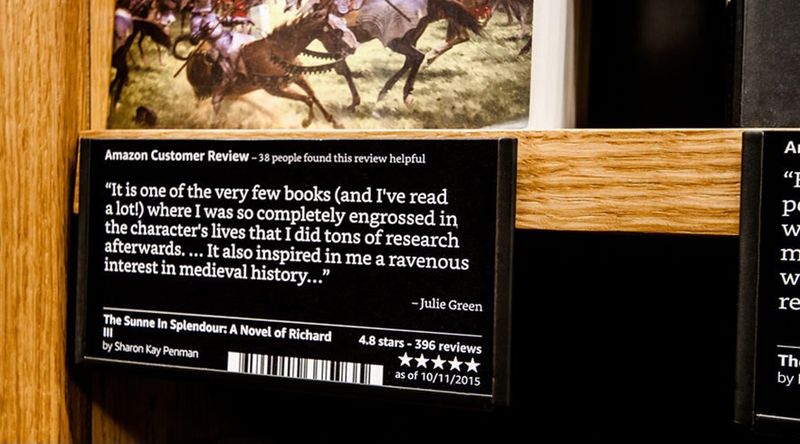

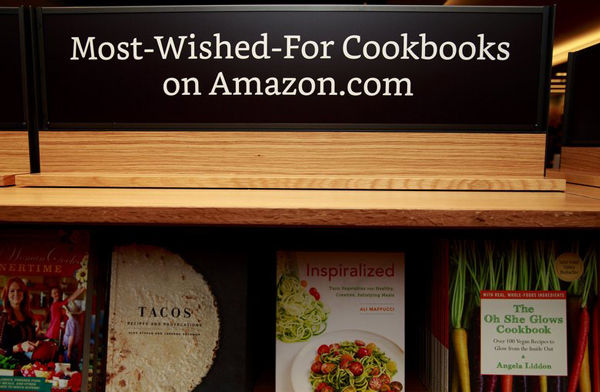

The books retail initiative will run similarly. If it makes a lot of profit, then they will scale it. Else they will make sure they launch in a few more relevant geographies — Boston, NYC, Chicago etc — to get access to data but keep cash burn low. The stores will function a supplementary channel that throws data back to Amazon, while also leveraging data thrown out by the Amazon machine (use of online recommendations in in-store display, use of sales data to pick a smaller sublist of books to display etc). In this regard, Amazon is following the likes of Warby Parker, Bonobos, BirchBox etc which have pop-up stores / guideshops that act as experiential touch points / points of sale for the online brand.

A good way to understand this trend is to see the traditional shopping as a mix of discovery / exploration, experience and transaction / fulfillment. What online stores are trying to do is to try and play with this mix.

- Bonobos guideshops allow customers to try out stuff but cant buy anything from the store. Purchases are delivered home, enabling them to carry minimal inventory and focus on offering a heightened consumer experience. They have deconstructed experience and fulfillment.

- Conversely, Amazon Books is trying to add discovery / exploration to fulfillment. It too carries minimal inventory like Bonobos, about a third of what similiar-sized bookstores stock, by leveraging sales data from its online store. They also show recommendations shared online to nudge retail customers. One interesting play on traditional bookselling is how they stack books – all facing outward.

It might be interesting to see Amazon, Amazon Prime Now (1–2 hr delivery) and Amazon Books as a continuum moving from longest fulfillment period to the shortest. Thus Amazon Books is essentially Amazon Prime Now with a 1-min fulfillment period.

Amazon will come up with more formats in the future along this continuum . In denser geographies such as NYC, does it make more sense to have a few electric buses stocked with books driving around Manhattan, which can be directed to go to a customers house upon an order? How would Amazon’s retail stores change with automated vehicles? Questions? Questions? All of which I am sure are being debated and discussed in Day One North.

Additional Reading

One article which really seemed to get the gist of what Amazon is trying to do was this one, by Fortune’s Don Reisinger.