Recently, Rehan Yar Khan, who runs Orios Venture Partners, an early stage venture firm tweeted

Starting with Zomato, then Ola in Australia and now Oyo in China, looks like Indian start-ups have found the answer to beating India's 50M only "real consumers" market: Get out of the box

— Rehan Yar Khan (@rehanyarkhan) May 24, 2018

Rehan Yar Khan wasn’t being sarcastic. He was, in fact, complementing the promoters of these companies for pushing away the constraints of an underdeveloped consumption market, as his next tweet shows.

To me the tweet unwittingly highlighted a fact well understood in the VC / startup world, but one that goes unacknowledged or isn’t understood in the outside world. That, all of India’s VC / PE funding, which reached a record $21b in 2017 (calendar year) was aimed at a market of ~30m real consumers.

There is perhaps a ~30m consumer / user market in India today

In my opinion, it is not even ~50m consumers as Rehan Yar Khan postulates. It is about 30m large, or small (see Annexure 1 for my estimate). These are individual consumers, which means around ~23m households, and a total population of ~110m people (going by the norm of just under 5 members per household), with an approximate per capita annual income of nearly $9k. They comprise about a tenth of India’s population but well over a third of its GDP.

This segment of India is what constitutes the audience for brands and services such as iPhone (10m users), Netflix (~500k paid subscribers) and Amazon Prime (10m members according to an industry observer). Within this segment are also India’s online shoppers (20m monthly active online shoppers), its flyers (~65m or 5% of the population) and its post-paid users (~50m).

When a typical VC-funded startup launches, it is really this segment that the startups are addressing. Whether it is a Raw Pressery, a Bira or a Nykaa, they are all targeting these ~30m paying consumers. In fact even the more mature startups such as an Ola or a Flipkart are yet to finish tapping out these segments.

It has long been popular to refer to this segment as India One (or India1 as I will refer to it), which along with its counterparts India Two (India2) and India Three (India3) rounds off the Indian consumer segments. I am going to stick to this convenient moniker, and through this prism lay out my thoughts on a variety of topics.

But first, let us look at these markets.

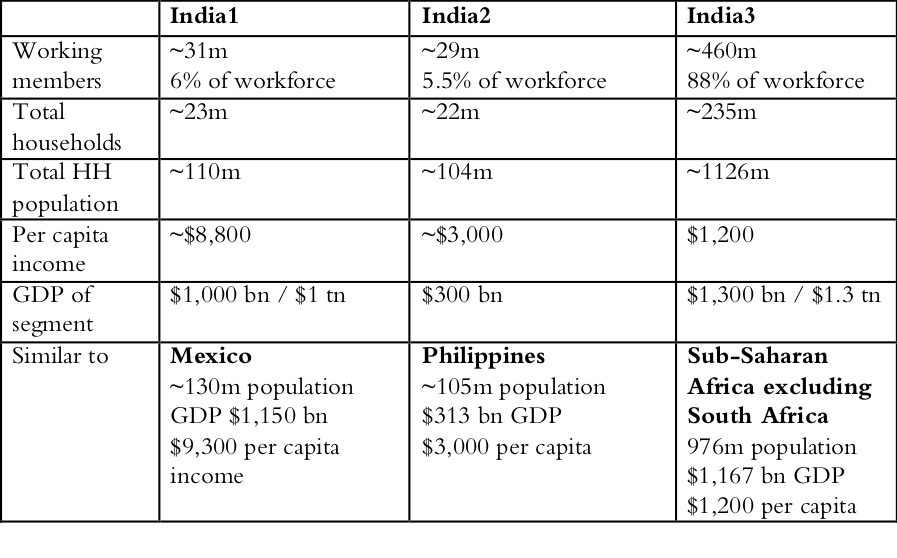

India1, India2 & India3 are akin to Mexico, Philippines and Sub-Saharan Africa

My estimate of these segments

- See Annexure 1 for how I arrived at these estimates. That said there have been many attempts at defining the size of these segments. I have compiled three such estimates – from Kishore Biyani, Haresh Chawla and iSPIRT / IndiaStack’s Sharad Sharma. See Annexure 2 for the same.

- Sub-Saharan Africa is Africa without the 5 North-African countries (Egypt, Libya, Tunisia, Algeria and Morocco)

Thus a good way to see India is as a combination of Mexico (for affluent India1), Philippines (for aspiring India2) and Sub-Saharan Africa excluding South Africa (for destitute India3); splurgers, strivers and survivors as one commentator put it to me!

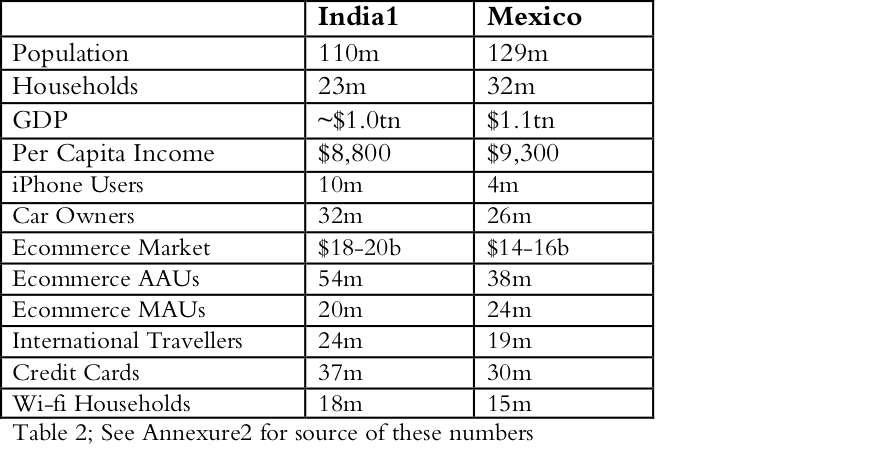

The following comparison between India1 (if it were a separate geographical unit) and Mexico reveals how similar the market sizes and consumption patterns are.

Basis these above numbers, I would hazard that the real effective maximum market size of paying users for most consumer startups / app-driven products In India would be ~30m.

India is an over-ventured market at ~22x Mexico’s VC market!

Thus, when we look at most consumer-oriented startups, including app-led ones, they are all playing at best in a Mexico-sized market of ~110m consumers. Keep in mind that Mexico’s early stage investments totalled $130m in 2016, and is likely at $100m in 2017. What about India?

Well, India’s early stage venture market size (investments) was at $2.2bn, 22x the size of Mexico! We are about 22x Mexico as well as Turkey (80m population, $10,500 per capita income) and nearly 4x Brazil (210m population, $10,000 per capita income). We are clearly an over-ventured market!

This reflects both in the quantum of funds that are put in startups as well as the type of startups that get funding. The former is well understood and there are enough examples of that. In the latter category we have examples such as

- Qikpod – a smart locker startup funded in 2015

- Raw Pressery – cold-pressed juices brand

- Beardo – men’s grooming brand

These are all niche use cases, which are very early for the Indian market or perhaps best run as lifestyle businesses. Nonetheless they got funded quite aggressively. What gives?

One reason is faulty market sizing i.e., estimating a much higher opportunity number than is realistic. It isn’t that VCs are not able to size it rationally. They are as rational as anyone out there. Most VCs do see a consumption class much smaller than is talked about. That said there is a land grab on, and they want to make sure they don’t miss out their presence on the cap table when the ‘Philippines’ part of India’s economy merges into ‘Mexico’ to grow into a ‘Brazil’. Hence massive rounds into Flipkart and Olas. And the big early bets on future-focused businesses.

Indian startups need to push for profits earlier than their Chinese peers

One interesting consequence of this funding land-grab and the overventured market that results is the need for startups in India to get to profits early. This is because of the nature of the funding funnel in India which is wide at Pre-A / Series-A and then narrows sharply around Series B/C investments. Let me elaborate.

Given that the effective user base is 20-30m (depending on the category), most brands hit a growth ceiling as they get closer to tapping this segment out. Now when a Series-B round happens in India, the investors who come in then are expecting their investment to be validated by the company raising a Series-C round (typically at $150-200m post money valuation). Hence a Series-B player only comes in when he expects the company to be valued at $150-200m at some point – for that the company has to be at 5m MAUs minimum / 18-24crs ARR (Reference). This isn’t easy given the real size of the market at 20-30m. Thus at some point past the Series-A, the VCs push the company which is slowing down to focus on making its existing funds count.

Hence the need for Indian startups to push for profitability much earlier than their counterparts abroad. The nature of the funding funnel is also a reason behind why E2E Networks listed on NSE Emerge. They just couldn’t raise even a Series-A despite being a well-run profitable co given that they fell short of traditional VC / PE funding benchmarks. Going forward we are likely to see more and more exits happen through this route, given the narrowing funnel.

Let us now get back to India2, for it is critical that a startup expand and win here, if it has to become the iconic investment that returns the fund.

To win in India2, avoid the ‘English Tax’

At some point, India2, the ‘Philippines’ part of India will get richer and expand into India1. Still, I am extremely skeptical of present India1-oriented products expanding their appeal to India2. As India2 gets richer and digitally-comfortable they are likely to look to native apps with no English tax and a UI that is non-intimidating.

I see Sharechat as the first of the ‘India Two’ native apps. There is zero ‘English tax’ on the product. You can’t use it in English mode at all. Compare it to Google’s payment app Tez, which they claim is built for the Next Billion Users in India, but is not easy to use for a Next Billion User to use. See Tez reviews here and here if you wish to understand why.

Let us move on to ‘English tax’. What exactly is this ‘English tax’? I define it as using English language and branding on and around the product to make its usage intimidating for non-English speakers. It may not be intentional but it nonetheless creates discomfort for non-English speakers in trial and usage of the product.

Let me illustrate it with Starbucks wall menus from 3 different countries, China, UAE and India.

The Indian menu doesn’t accommodate any Indian language. Exclusive English text and the overall design / aesthetics communicate the exclusive and even exclusionary nature of the place. It intimidates an affluent but non-english speaker. Imagine a rich businessman from Satara or Meerut who walks in to a Pune or Delhi Starbucks. This heavy English tax discourages him from ordering a coffee there. Contrast it with a 5-star hotel, which is an even more expensive space but with much lesser English tax – less English signages, lots of servile staff – making it far more palatable for the non-English speaking affluent customer. Of course, the fact 5-star hotels also cater to international tourists who don’t speak English also helps in creating a space with lower English tax.

What is bad enough offline – a product with a heavy ‘English tax’ – is even worse online.

Building for India2

It isn’t just translating all the English text you have into Hindi or Bengali. There is also a need to rethink the UI from the ground up in order to make the product non-intimidating e.g., lesser choice, voice-assisted set up, non-minimalistic design etc.

Snapdeal did have Hindi and Telugu translations of its English mobile app, but this was fundamentally window dressing. For the UI didn’t change. And that matters. I have always felt that choice and more choice is a very India1 way of shopping. It means a certain base awareness of brands and general knowledge about the category. The traditional native format for offline retail for India One is the supermarket where you self-select, and that carries over into online ecommerce design – Amazon, Flipkart etc.

But that isn’t how India2 shops. They engage in a conversation with the shopkeeper. The traditional native format for offline retail for India2 is the Kirana store where the shopkeeper tells them “Haanji Guptaji, yeh badiya hai, ye lijiye” and they pick up the product. For them to move from Hindi or local language-assisted offline shopping to English non-assisted online shopping is a leap. It isn’t that they can’t do it, but it is a challenge. Then add issues around online payment (lack of credit cards), lower spending power and delivery issues, and it is a wonder India2 shops online at all.

In this context, I have always thought a Wirecutter transplanted to vernacular soil, with fulfilment (not affiliate sales) would be a formidable ecommerce business model. Editorial curation may well be a far bigger driver of ecommerce in India2 given how much sales here is advice-led.

My theory is that India1 products will struggle to expand into India2 territories. To build for India2, we will have to create entirely different formats with minimal English tax and lower-friction UIs that get the job done. So we may well see India1 brands create distinct vehicles for India2 the way publishing houses have two distinct vehicles for each market.

If engineers from IIT Delhi and IIT Bombay were the team behind Flipkart and Ola, the poster boys of startups catering to India One, it will likely be engineers from IIT Kanpur and IIT Kharagpur (or any selective non-metro institutions) who will find the definitive India2 startups. Not surprising then that the Sharechat founders are from IIT Kanpur. Or even if you circle back a little, that two engineers from BITS Pilani founded Redbus, another formidable native India2 business.

Getting from ‘Mexico’ to ‘Brazil’

We are near Mexico presently at ~110m population and per capita of $8,800. We will at some point get to where Brazil is now at ~210m population and $10,000 per capita. But clearly what got us here won’t take us there.

We built for Mexico replicating what happened in Silicon Valley using ‘English UIs’ for Indo-Anglian users and use cases. But to get to Mexico, we have to look at Chungking and Lima and Manila, and perhaps Lagos and Kinshasa as well. It will mean looking at founders who come out of small town India who want to build for the problems they see, not what they read on HackerNews, and reworking the UI to suit users from Satna and Cuddapah.

We will of course get to Brazil. How soon and with what vehicles remains to be seen.

***

Annexure 1

A 2016 report from Goldman Sachs gives us a good approach to classify Indian consumers. I have used this report to build up my estimates shared in Table 1. Please refer to the report to understand the below explanation.

To arrive at the 31m user base of India1, I merged the top 10% of Urban Mass with Urban Middle and Movers & Shakers to arrive at ~31m. This is India1. The balance members of Urban Mass, about ~29m are India2. The remaining are India3.

As these are earning members, I used the estimate of 1/3rd households being dual-income households to arrive at the number of households for India 1 – 23m and India2 – 22m.

Each household in India has 4.8 members as per the 2011 census. This was used to arrive at the total total number of households, i.e., 279m as well as the size of the population in these segments 110m (India1), 104m (India2) and 1,110m (India3).

The per capita income and GDP estimates of India1, India2 and India3 were built by extrapolating the Urban Middle and Urban Mass working population sizes and incomes (Exhibit 2 of Goldman Sachs Report; page 7 of 22) to 1,339m people (India’s population at present) and present GDP of $2.6 trillion.

Exact calculations can be made available on request. Mail me at sp@sajithpai.com

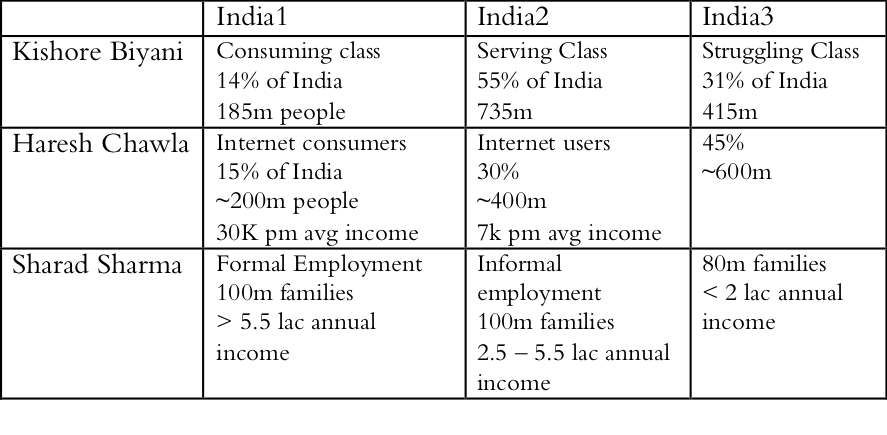

Annexure 2

There have been several definition of India1, India2 and India3. Let me list three.

Source: Kishore Biyani’s description from his book ‘It Happened In India’, 2007, Rupa & Co. Haresh Chawla’s from here. Sharad Sharma’s from here.

I do think these above definitions vastly overstate the size of the consuming class in India. Kishore Biyani & Haresh Chawla’s 180-200m estimate and Sharad Sharma’s 450m estimate are out of whack with some of the numbers that emerged and are shared in Table 2. Let me share the source of the numbers in Table 2.

- 10m iPhone users (source)

- 18m wi-fi households (source)

- 20m monthly ecommerce shoppers (source) & 54m annual ecommerce shoppers (source)

- $18-20bn ecommerce market (source)

- 32m car owners (source: 28m as per this, updated to 32m for 2017; 70% of used car sales (apprx 3.5 to 4.0 mn each in last two years) is by first-time buyers, as well as 40-50% of new cars (~3m each year). Hence updated 28m to 32m – taking into account older cars exiting the system.)

- 37m credit cards (source)

- 50m post-paid mobile accounts (source)

- 59m tax payers (sourced from Economic Survey 2018, Govt of India)

- 65m domestic flyers (source) and 24m international flyers (source: 22m in 2016 as per this, upped to 24m in 2017)