An open letter to John Fallon, Chief Executive of Pearson Plc

Dear John

For the nth time, congratulations on the sale of FT to Nikkei for £825m ($1,288m).

Everybody says £844m, but you and I know that with FT Group’s £19m in the bank, the funds you have got from Japan are a tad lower at £825m. Still that is a bucketload of money. And with The Economist Group’s 50% stake valued at £365 ($570m) as per Richard Beales (or £400m / $620m) if you trust the “two people familiar with the matter who asked not to be identified because the discussions are private.”) we know there is more to come.

And then there is the 47% stake in Random House, which your German partners Bertelsmann are keen on. Bloomberg thinks the company could be valued at $2.9b. If that goes through, Pearson could get another $1.3b (47% of $2.9b purported valuation). So, all in all, if you are able to get the sale of Economist Group (very likely) and Penguin (possible) through, Pearson will have about ~$3b in the bank.

It is time to go shopping, John.

So what should should you look at? Should you look at buying Coursera, the future of higher education? Or perhaps Minerva? Or should it be Clever, the rather aptly-named fast-growing edtech co? Or the privately-held but little-known Education First? Hell, it could buy you even 2 or more companies, given that it is the education sector. Mmmm, choices John, choices.

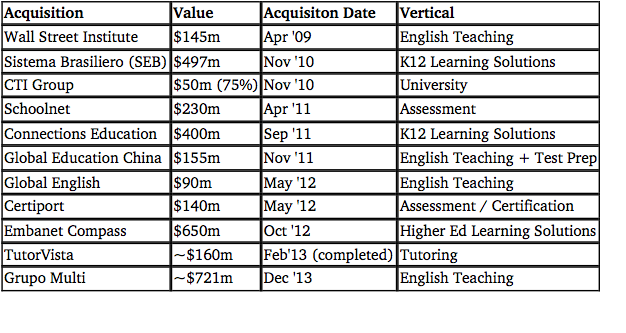

Before we look out, let us look within Pearson, and understand the company that it is, to better structure our search. Given the profusion of brands and businesses that Pearson has, from CTI in South Africa, to TutorVista in the US, to Wall Street English in China and MyLab everywhere, it is hard for anyone to get a clear sense of where Pearson is, in the educational landscape. It seems to have a finger in every part of the educational pie possible.

Still, if we examine it closely, the various parts do seem to coagulate around a few lumps. These lumps are

1) English Teaching – through brands such as Wall Street English, Global Education China, Grupo Multi etc

2) Assessment – Pearson VUE, BTEC etc, Schoolnet (products across all age groups including driving test certification)

3) K12 Content & Services – Connections Education, EnvisionMath, PowerSchool etc

4) HigherEd Content & Services – MyLab, Embanet Compass, Pearson College etc

So, the question to ask would be – does Pearson wish to strengthen what it already has, and achieve dominant marketshare? Or should it go after what it doesn’t have?

If the first, Pearson could strengthen its English hand by looking at buying say, the Hult-family owned Education First (the largest family-owned education venture today). Similarly it could acquire publicly-listed 2U to complement Embanet Compass etc.

If the second, i.e., to beef up on where it is weak, Pearson can look at two broad areas

a) For-Profit Colleges – Thanks to the Obama administration measures to curtail the federal funds flowing into dubious for-profits, this entire category (with many public companies) is trading at record lows. Apollo Education, with revenues just under half of Pearson, is trading at a tenth of Pearson’s value. Apollo’s (net) profitability isn’t too different either, at 8% odd v Pearson’s near 10%.

b) EdTech Companies – Silicon Valley rethinks solutions to the common pain points in education from the grounds up, combining tech, design and innovation to create truly original business models such as Edmodo, Knewton or Skillshare. Is it time to look at making a play for one of these EdTech Unicorns or to-be Unicorns?

What is particularly interesting is that a fair bunch of the startups are all in the college replacement space – be it Enstitute, MakeSchool, Praxis or even the likes of General Assembly or HackReactor, who are supported by players such as Portfolium or Pathbrite which are laying in place the certification engine that will convince employers about the value of the education provided by the college replacement model. If thus college replacement model takes off, then it will also pull down the traditional higher education market, impacting a substantial part of Pearson’s business. All the more reason, I think, for Pearson to look closely at the EdTech space.

I would highlight 3 areas that you could explore here –

1) Certification, especially in creating the pre-eminent e-portfolio brand. After all, Pearson likely has the biggest assessment business in the world. It has expertise in measuring hard as well as soft skills. Is it time, then to leverage these strengths into creating an e-portfolio? Perhaps acquire a Pathbrite (though that won’t take much money). Perhaps better still, Pearson could acquire Chegg – with its rich student database and access to data across what hundreds of thousands or students are seeking learning resources for. Chegg is listed, and despite revenues of $300m last year, is only worth $700m or so. Pearson is unlikely to get it at that value. Bidding for it will draw interest from other investors, and will likely lead to an uptick. Still I think for you about ~$1b or thereabouts you could have an education company with last-mile access to ~50% of all college students, on which you can start building an e-portfolio service, shutting out competitors.

2) Online Learning Marketplace – connect learners to tutors, who in turn are vetted and curated so as to be of sufficiently high quality. This is the digital equivalent of the University and is best exemplified in players such as PluralSight, SkillShare, Udemy etc. Of the three, PluralSight is the most impressive, focussed around a strong niche, IT Training + Development. It has also acquired skills testing co Smarterer with a view to adding a ’skills-oriented credential’ to enhance the value of the courses offered. PluralSight’s last round put it at nearly $1b valuation. So in all likelihood For $1.1-1.2b, Pearson will have the strongest learning marketplace in the online world.

3) Enhancing the Tech Quotient of Content – In 2011, you would recall that Pearson took a small stake in Knewton, an adaptive (personalisation) learning focussed co. This was part of an overall deal where Pearson moved some of its content onto Knewton’s adaptive learning platform. As we have seen with media, vanilla content will increasingly become a commodity, with more and more value captured by the distributors such as Edmodo, or platforms such as Knewton, which intermediate between end-users and content providers. Pearson has the funds to acquire both Edmodo and Knewton. Acquiring Knewton would do give you access to a personalisation engine which can then be layered across all your content, while acquiring Edmodo gives you access to a network of 55m teachers, parents and students, through which you can drive content and services. Knewton’s last known valuation was $400m after a Series E round. I am not sure if it would have changed substantially, but for $500-550m, Pearson could own all, if not, most of it. Edmodo’s valuation is not clear but I should think, it would be lower than Knewton, at about $300 or so.

So, buy Chegg, PluralSight, Edmodo & Knewton. The resulting company will be a more vertically integrated co, with last mile access through platforms such as Chegg (Higher Ed) and Edmodo (K-12). These pipes will be powered with value-added content, enhanced by Knewton’s personalisation engine, and Pearson’s existing assessment machine.

The above structure, allied to what Pearson already has, would help you ride the key trends that are powering today’s education marketplace

1) In Higher Ed, we are seeing a trend of college replacement / skilling outside college framework

2) In K12, we are seeing a focus on measuring and enhancing learning outcomes (efficacy John, efficacy)

3) And beyond that we are seeing a huge drive towards lifelong learning, through marketplaces that connect tutors to learners.

I hope this note will give you something to think over, John. And I hope you will enjoy reading it, as much as I have enjoyed writing it.

Yours sincerely

Sajith Pai

***Supportings

Pearson’s past acquisitions (sizeable and relevant to higher ed)