Enjoyable listen this, as Harry Stebbings interviews Cem Sertoglu, an elite European seed investor, who led, very likely the single best seed deal on the continent, the UiPath investment, where he has turned $16.5m invested (the last $10m written as part of the Series B round “with our hands shaking at the time”) into $2.1b. Whoa! Cem (pronounced as Gem) shares a behind the scenes look at the UiPath investment …

Venture Capital / Startups

Podcast Notes: Chris Paik, Pace Capital, on Turpentine VC, w Erik Torenburg

12 November 2024 | Link to podcast episode

Surprisingly good podcast episode. I encountered Chris Paik first on a Invest Like the Best podcast episode which was interesting as well, and then again recently when his post ‘The End of Software’ went viral. He is an interesting thinker as you will see from the highlights of this episode.

A few points which stood out:

- On Thrive Capital, his previous employer,

PMF Convo #19 – Romita Mazumdar, Foxtale

In my latest PMF Convo interview, I spoke to Romita Mazumdar, founder & CEO of beauty products co Foxtale. Romita is a VC analyst turned founder, who started Foxtale during the COVID-19 pandemic, speaking to 900+ women and 100+ brands to figure out the specific sub-problem she wanted to attack in the beauty space. Her earned insight was that Indian customers want instant gratification, and efficacy, and she designed …

Podcast Notes: Matt Cynamon, USV, on ‘AI & I’ with Dan Shipper

30 October ’24 | Link to podcast and transcript

One of the more interesting podcast interviews I have consumed in the past months / yr. Matt Cynamon the ‘Head of Library Sciences’ at Union Square Ventures comes on the AI + I podcast with Dan Shipper to talk about all the cool AI stuff they are cooking up at Union Square Ventures (USV).

You may have seen the OH (overheard) …

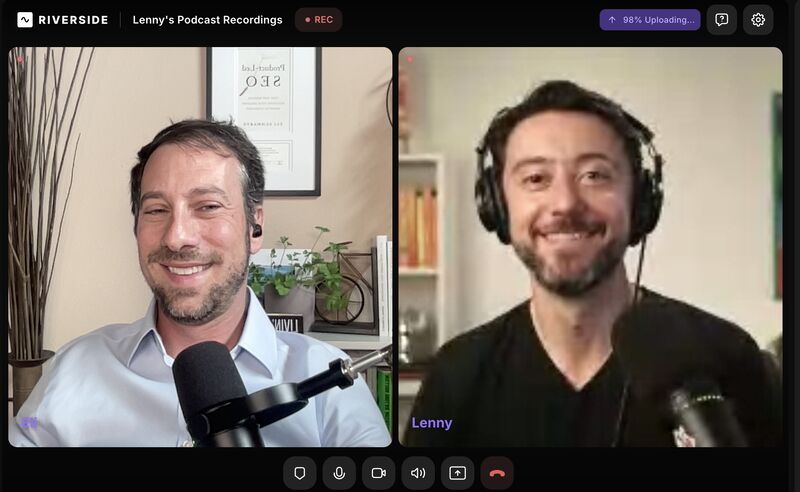

Podcast Notes: Eli Schwartz, SEO guru, on the Lenny Rachitsky Podcast

19 September 2024 | Link to podcast + transcript.

Loong episode at nearly 2 hours, but worth a watch for any founder / operator wrestling with SEO or content. Eli is one of the foremost thinkers in the SEO space today, author of the book ‘Product-Led SEO’ and advisor to Zapier, Tinder, LinkedIn etc.

In the podcast, he covers how AI / LLMs will impact search / SEO. Effectively …

Podcast Notes & Thoughts: Lulu Meservey on Colossus’ Invest Like The Best

Lulu Cheng Meservey is the founder of Rostra, the ‘PR’ firm du jour, and the high priestess of the ‘go direct’ movement, where founders are encouraged to front the message about their co to the world, instead of relying on internal or external PR teams to front their point of view. I first came across Lulu on Twitter when Dwarkesh Patel thanked her for connecting him to Daniel Yergin…

Podcast Notes: Ben Braverman, Thomson Nguyen, and Max Altman of Saga Ventures on Venture Unlocked

Link to podcast and transcript, organised by Venture Unlocked. The podcast was published 26 September 2024.

Saga Ventures raised $125m for their first fund. In this episode, the three cofounders and Partners, Ben Braverman (ex Flexport), Thomson Nguyen (Square), and Max Altman (Alt Capital) talk to host Samir Kaji on their fundraise, and the experience of raising in a tight fundraising market.

What I found interesting –

- Fundraising

- Samir

PMF Convo #18 – Srikrishnan Ganesan, Rocketlane

As part of the PMF Convo series, I recently spoke to Srikrishnan Ganesan, cofounder and CEO of Rocketlane, a SaaS startup that sells software for better customer onboarding, implementation, and professional services automation. In June ’24, Rocketlane raised a $24m Series B co-led by 8VC, Z47, and Nexus Ventures on the back of strong market momentum in the U.S. market. This was on the back of an $18m …

PMF Convo #17 – Mohit Kumar, Ultrahuman

I recently spoke to Mohit Kumar, cofounder and CEO, Ultrahuman, a fast-growing consumer health startup, as part of my PMF Convo series, where I speak to founders, operators, VCs who have struggled with PMF (product-market fit) successfully, or unsuccessfully, with the startups they have founded or worked with (or work at).

Ultrahuman sells such devices as the Ring Air, a sleep tracking wearable; M1, a continuous glucose monitoring …

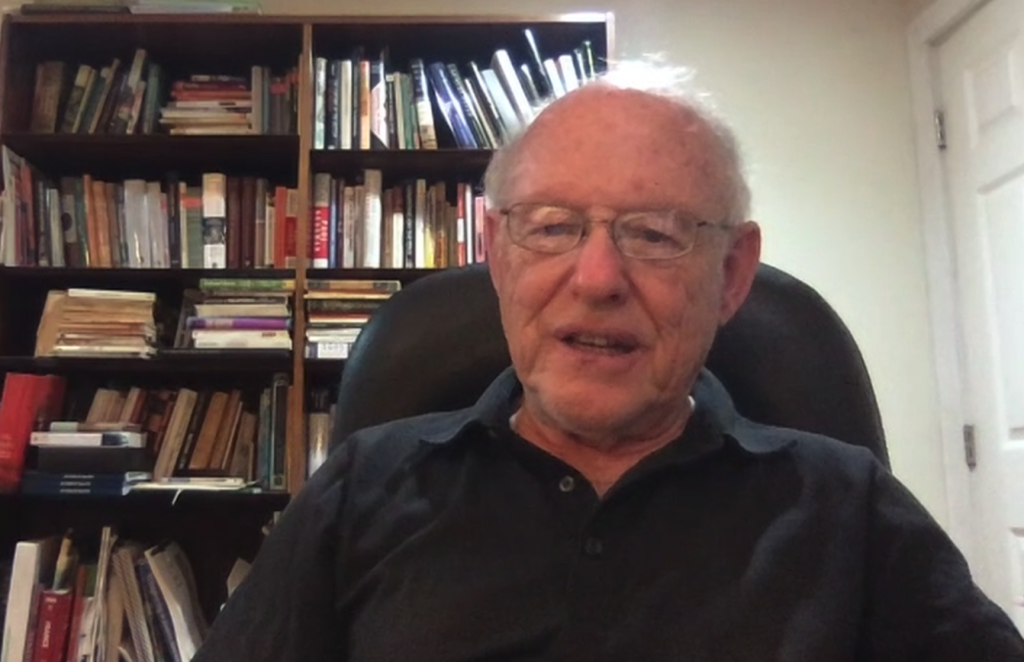

Oral History: Mel Goldman, Indian Venture Pioneer

Mel Goldman has a central role to play in the origin of India’s now flourishing venture industry. In the late ‘80s, as the World Bank officer in charge of the Industrial Technology Development Project, he identified four local partner institutions (who thus became venture capital firms) for loans, earmarked for the specific purpose of these institutions providing venture capital in turn to innovative Indian ‘startups’. From this initiative, the seeds …