What I read and found interesting of late. The title ‘Interleavings’ comes from publishing. Interleaved books are those sold with blank pages inserted between printed pages so as to facilitate note-taking. This was a common practice in the 16th and 17th century, but has disappeared now. Thus my term ‘Interleavings’ for my notes and thoughts on the digital texts I enjoyed reading. Here are my interleavings from the recent past.…

Venture Capital

Interleavings: Notes & thoughts on recent reads, 13 April ’25

In publishing, interleaved books are those sold with blank pages inserted between printed pages so as to facilitate note-taking. They were a common practice in the 16th and 17th century. Here is how an interleaved book with notes by the reader (source) looked like –

Thus my term ‘Interleavings’ for my notes and thoughts on the digital texts I enjoyed reading.

Here are my interleavings from the recent …

Reflections on completing 10 years in Delhi

I recently completed 10 years in Delhi, India’s capital city. Well, strictly speaking, I have lived the last decade in Noida, a satellite city of Delhi, part of the Delhi National Capital Region (NCR), and tightly integrated with Delhi, and so this will do. Neither me, nor my wife, have roots or relations in Delhi or the wider region. So what am I doing here in Delhi?

Well, we moved …

What I Read and Enjoyed Lately: 23 March 2025

Podcasts

1/ Chris Pedregal, founder + CEO at Granola on the Colossus’ Invest Like The Best podcast w Patrick O’Shaughnessy

Link to podcast. Link to podcast excerpts i found interesting.

Some of you may recall that Chris wrote a terrific piece a few months back on how founders should think about building AI products. This podcast is in much the same vein though I found it somewhat less useful …

Venture as temporal arbitrage, and the rise of marketmaking in venture.

This is a brief review of the essay Making Markets in Time by Abhraham Thomas.

I first heard of Abraham Thomas, from my then IIMA junior Sudhir Sitapati. This was just before Malhar ’97, the Xavier’s college fest. I was in the IIMA team for the Malhar quiz, and Sudhir told me that AT (as Abraham Thomas was called) was a formidable quizzer representing IITB. For some reason Sudhir, …

Podcast Notes & Highlights: Cem Sertoglu, Bek Ventures, on 20VC w Harry Stebbings

Enjoyable listen this, as Harry Stebbings interviews Cem Sertoglu, an elite European seed investor, who led, very likely the single best seed deal on the continent, the UiPath investment, where he has turned $16.5m invested (the last $10m written as part of the Series B round “with our hands shaking at the time”) into $2.1b. Whoa! Cem (pronounced as Gem) shares a behind the scenes look at the UiPath investment …

Podcast Notes: Matt Cynamon, USV, on ‘AI & I’ with Dan Shipper

30 October ’24 | Link to podcast and transcript

One of the more interesting podcast interviews I have consumed in the past months / yr. Matt Cynamon the ‘Head of Library Sciences’ at Union Square Ventures comes on the AI + I podcast with Dan Shipper to talk about all the cool AI stuff they are cooking up at Union Square Ventures (USV).

You may have seen the OH (overheard) …

Podcast Notes: Ben Braverman, Thomson Nguyen, and Max Altman of Saga Ventures on Venture Unlocked

Link to podcast and transcript, organised by Venture Unlocked. The podcast was published 26 September 2024.

Saga Ventures raised $125m for their first fund. In this episode, the three cofounders and Partners, Ben Braverman (ex Flexport), Thomson Nguyen (Square), and Max Altman (Alt Capital) talk to host Samir Kaji on their fundraise, and the experience of raising in a tight fundraising market.

What I found interesting –

- Fundraising

- Samir

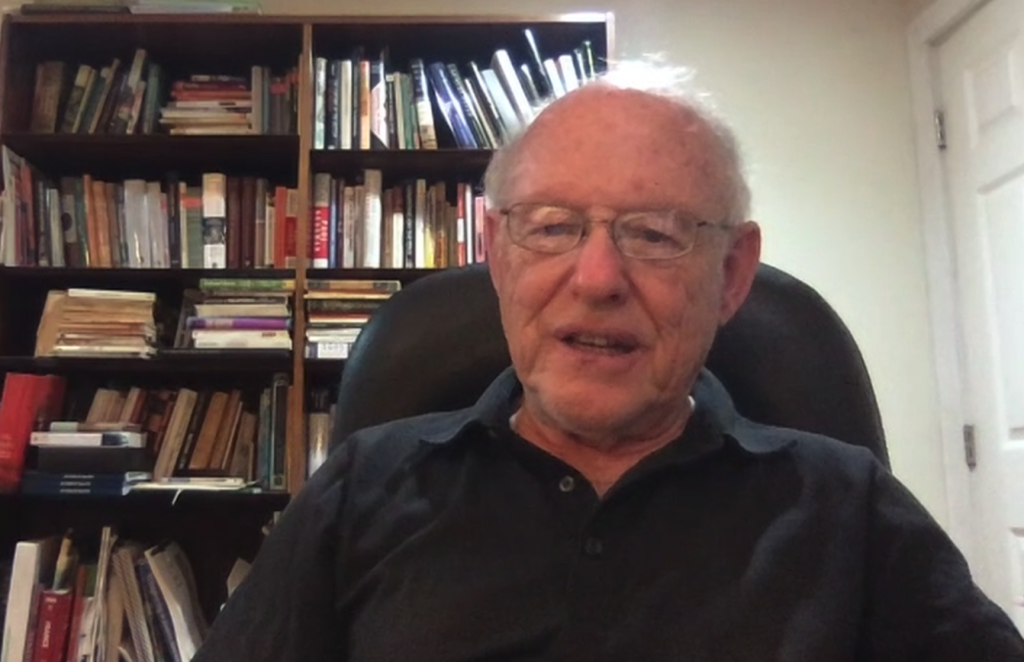

Oral History: Mel Goldman, Indian Venture Pioneer

Mel Goldman has a central role to play in the origin of India’s now flourishing venture industry. In the late ‘80s, as the World Bank officer in charge of the Industrial Technology Development Project, he identified four local partner institutions (who thus became venture capital firms) for loans, earmarked for the specific purpose of these institutions providing venture capital in turn to innovative Indian ‘startups’. From this initiative, the seeds …

TAM: Notes & Thoughts

Reflections on Total Addressable Market (TAM); why TAM doesn’t matter but thinking about it matters.

TAM is the carpet under which the lazy VC buries his no’s.

If you are a founder and get a pass from a VC who cites low TAM (Total Addressable Market) as a reason for passing, then be rest assured that in nine out of ten cases, that is not the real reason. The real …