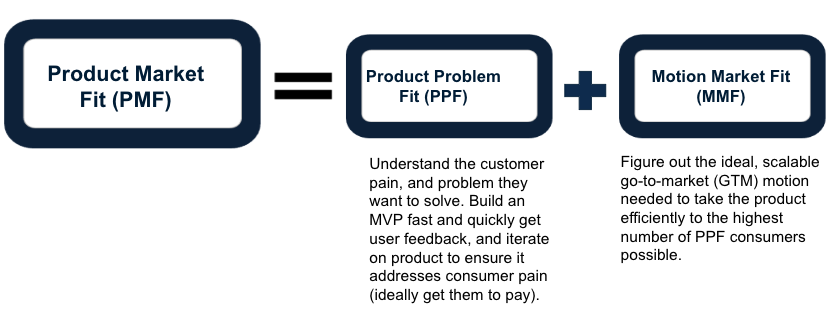

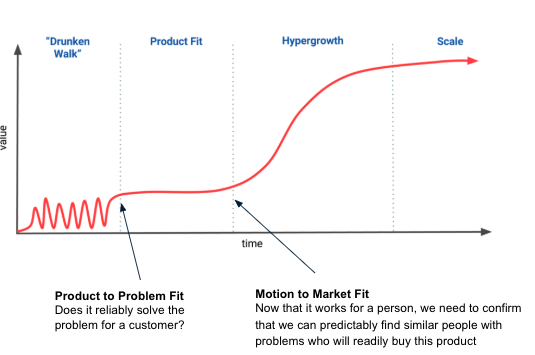

TL;DR: PMF or Product-Market Fit is not a singular fit, but in fact two sequential fits. First, you need to achieve Product to Problem Fit or PPF (where you validate that your solution is able to address problems for a set of customers), and then you need to achieve (Go-to-Market) Motion to Market Fit, or MMF (where you can reliably, affordably, acquire lookalikes of the above customers to build a large business). Both together help you achieve PMF or Product Market Fit.

Product-Market Fit = Product to Problem Fit + Motion to Market Fit. PMF = PPF + MMF.

The biggest error founders make is confusing PPF (product love from a few customers) for PMF, and then pouring on the GTM / customer acquisition fuel in advance of true PMF.

I. Defining PMF

PMF is often the single most important thing that an early stage founder is after.

Source: X / Twitter

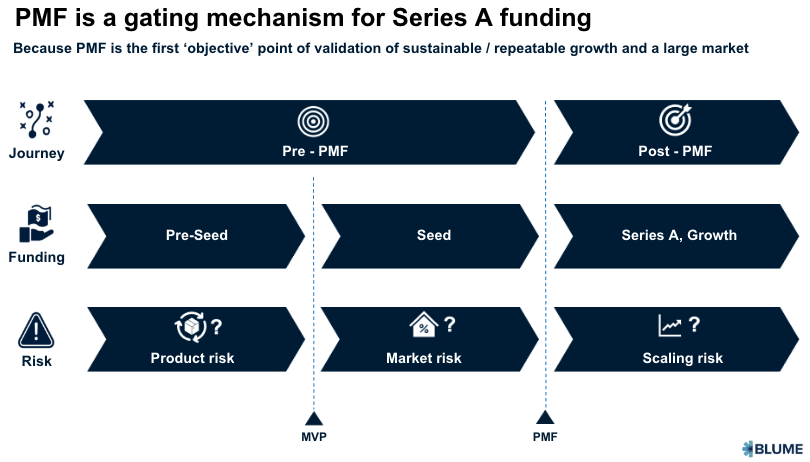

Yet, it is alarming that we still don’t have one clear consistent definition or even approach to achieving it. This is worrying because premature scaling in advance of PMF is the key reason for startup failure (Startup Genome et al). And critically it is a gating mechanism for most Series A VCs, and all Series B VCs. A brief detour.

To clarify

- Pre-seed covers product development risk. This stage is where angel investors or friends and family come in (now you see MicroVCs also in this stage).

- After attaining MVP, you typically raise a seed round. The seed VC comes in and helps cover market development risk and achieve PMF. At this stage, there is proof that a market exists, and that there is a playbook to achieve it.

- The final stage, post PMF, is the Series A+ stage going from early growth to late growth. Here the key risk is scaling risk. Capital here helps underwrite the risk of scaling to multiple channels or markets.

PMF matters because you need to make sure that before you throw in more money, you know you have acquired the right customers. This is why early stage VCs are concerned about user acquisition strategies like cashback, which can lead to the wrong kind of customers coming on board. PMF means determining genuine demand for the product and ensuring you have a systematic way of tapping this demand.

Before you go big, you need to get it right. This is what PMF is. It is a way of assuring yourself and your investors of the appeal of the product as well as a plan for growing it systematically. Post PMF, it is effectively a rinse and repeat strategy. PMF is effectively the nailing before the scaling.

Now back to the definition.

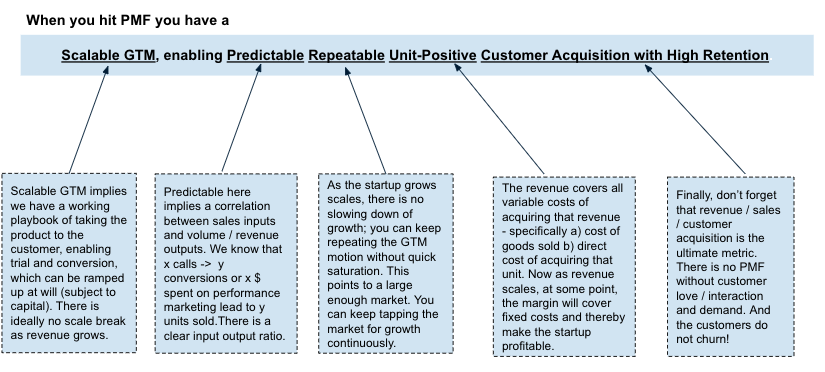

My definition of PMF is that you have a scalable GTM motion enabling predictable, repeatable, unit-positive acquisition of customers with high retention. Phew, it is a mouthful, I know. More details in the image.

Now, I know that was complex. Let us see if we can make it simpler. Now, founders have been achieving PMF before it was coined by a VC (Andy Rachleff)! Good founders know that PMF is an abstraction layer over ‘growth with high retention’. Ideally you want to make sure it is sustainable growth, or growth and retention with good unit economics. A shorthand acronym is GRUE = Growth with Retention and Unit Economics. PMF = GRUE effectively. That is a good shorthand definition. If you understand that much and that is the only takeaway from this post, I will be happy!

To achieve PMF, founders need to work through a 2-step process.

First: achieve Product to Problem Fit, or PPF

Second: work towards (GTM) Motion to Market Fit, or MMF

PPF + MMF = PMF

I have layered on the two stages of PPF and MMF on an image that I ‘stole’ from an article by Nikhyl Singhal (‘Stage of company, not name of company’)

Caveat: Marketplaces, SaasTra and media plays have two-stage PMF. For example, in the media business, PMF has to be effected twice, first for user acquisition, as you capture customers through content, and then monetization when you sell it to advertisers. So PMF has to be achieved twice here. Priority should be given to acquiring customers; only then should you focus on monetisation.

Typically in Marketplaces, there are two sides (buyers and sellers; users and providers etc). One is easier than the other to acquire and scale. It is an art to figure out which is harder to scale. Sometimes it is the one that pays though not always. For example, in Uber and Urban Company, the supply side is harder to scale. As a first principle, the side which has more options tends to be harder to scale.

For marketplaces, PMF is figuring a repeatable plan for onboarding the harder side. For example, imagine a daycare marketplace. Parents are desperate for day care centers (they become the easier side), but these centres are harder to onboard and scale (and this is the harder side). So you need a working playbook for acquisition of daycare centres. Monetisation is the second part, though it can’t lag too far behind.

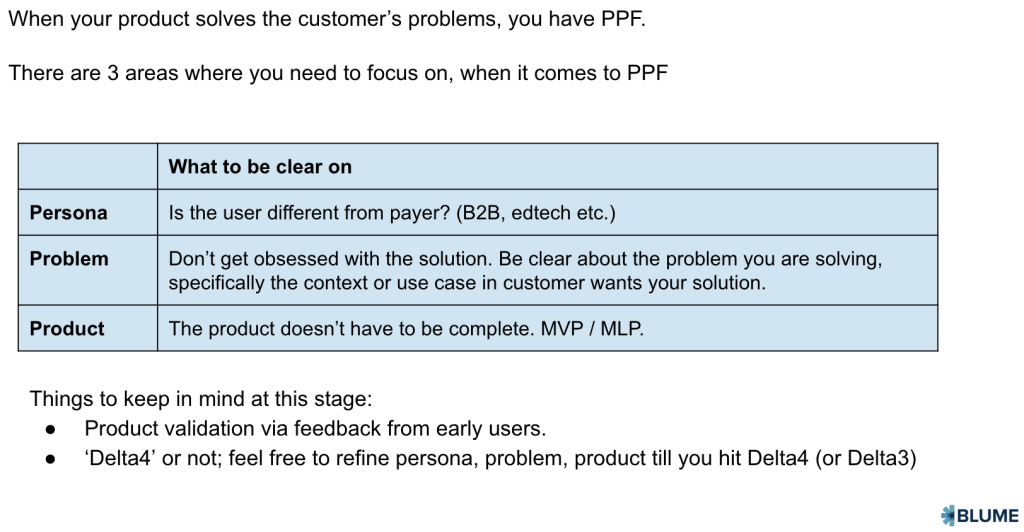

II. PPF or Product to Problem Fit

Here you confirm that your product consistently solves the customer’s problem. Does the pain that the customer have, a problem that he or she has, go away when they are using your product or solution? If so, you have achieved PPF. That said PPF is not an on/off switch or a zero one thing, it’s a continuum of strength of fit. By iterating on the ICP, and / or enhancing the product, you can improve PPF.

Early in their journey, Urban Company found that the people who experienced their service through a marketplace (where they connected buyers and sellers of services and took a cut) had lower CSAT scores, whereas those they served directly via their full stack service offering saw higher CSAT scores. And they found that specific personas like working women and new mothers needing home beauty care, saw the highest CSAT scores and repeats. And that is when they said, we have to drop the marketplace and we have to focus on owning the experience, and we have to figure out more and more categories like home beauty care where people need it so badly.”

Similarly Superhuman used the Sean Ellis Test to narrow down the ICP to what they saw as their HXC or high expectation customers (as Julie Supan terms it) – founders / managers / executives in business development. The Sean Ellis Test (which is per me a test of PPF more than PMF) says if more than 40% or more reply ‘very disappointed’ to your question on ‘How would you feel if you could no longer use the product?’ then you have hit PMF (per me this more a test of PPF than PMF).

How do you know you have PPF?

Other signals apart from the Sean Ellis Test include

– B2C: High engagement, usage: Retention curve flatlines at 10% at D90

– B2B: Speed through the funnel

- 30-45 days for SMB

- 2-3 months for midmarket

- 6-9m for enterprise

– B2C, B2B: Referrals, Word of mouth. Organic channels constitute majority of leads / lots of inbounds etc.

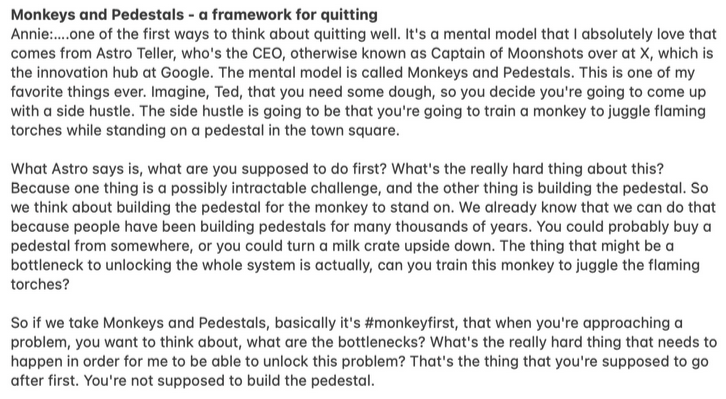

Important: Don’t overbuild the product at this stage. Time is money. Break down your assumptions about product-problem fit into modular components and test the hard things first.

I am reminded of an Annie Duke interview where she describes an Astro Teller framework: Focus on the monkey, not the pedestal! Solve for the hardest thing first!

Source: Podcast

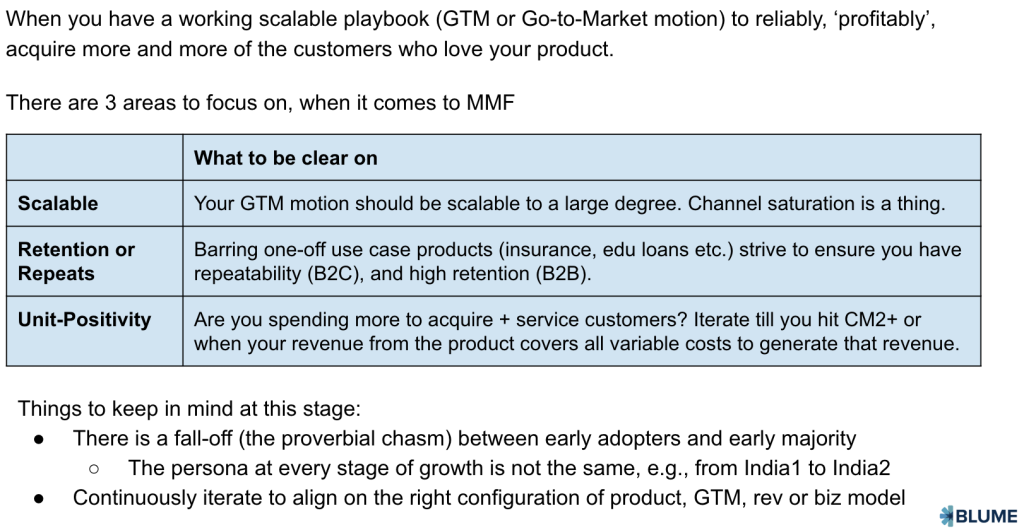

III. MMF or Motion to Market Fit

The second part of PMF is to have a repeatable, scalable GTM or Motion to Market Fit (MMF).

You hit MMF and thereby PMF when you have a scalable affordable go to market motion, i.e., you have predictability and repeatability of customer acquisition and that means a clear input output ratio. In addition, you are not overpaying for the customer, and you are also able to retain the customer.

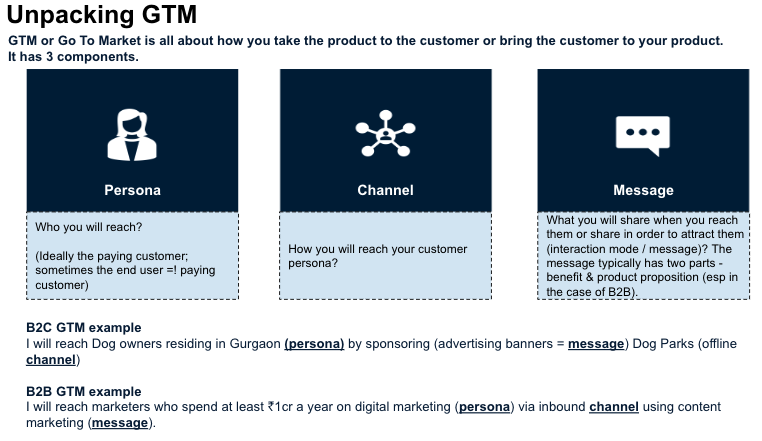

GTM comprises persona (customer type you wish to serve), channel (to reach the persona) and finally the message or proposition for the customer re your product.

‘Uncomfortably narrow’ personas addressed by one hero channel through a sharp message is how first-time MMF is achieved.

The process of achieving MMF (and eventually PMF) is fiddling with several knobs and dials in order to get to high fidelity. Some key knobs and dials to fiddle with or iterate upon are organic growth, lowering CAC, flatline retention, driving speed through the funnel, etc.

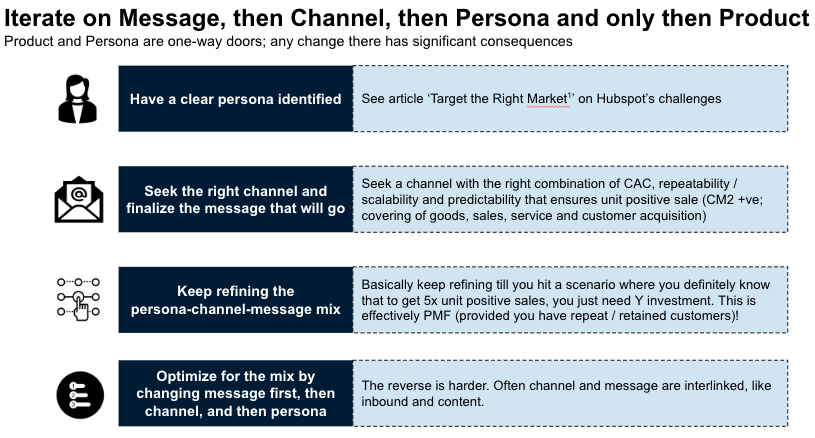

To achieve Motion-to-Market fit, iterate systematically and strategically. If you are not hitting MMF, then start by changing the message, and if it doesn’t work, then the channel, then the persona and only then the product. Messages are easy to change, you can try different things, etc. You can also change channels. For example if email is not working, try Linkedin ads etc. Finally, then you need to change the persona you’re targeting and this is hard. Now you’re getting into pivots. Persona change is tough. And finally you reach into the product. Product pivots are harder. Effectively you are throwing out everything that you’ve built thus far. Because you have money for 18 months typically (each raise covers 18 months of burn), each pivot is a life. You have at best 1 channel (market pivot) and 1 product pivot in you.

Caveat: There is a popular saying in the startup world that the first time founder thinks product while the second time founder thinks distribution. A better way to put this is that the best founders do not think of product and distribution in isolation; rather they think of product and distribution as joined in the hip. They think about distribution at the time of product development. Importantly they look to identify a proprietary or untapped distribution channel. One where they have a distinct advantage, and one where channel saturation is unlikely (or at least some time away).

Caveat #2: As far as possible, pivot on the market, not the product. It is much harder to change the product to fit the market; vice versa is what you are seeking. To change the market, you have the following three components – persona, channel, message to play with. First change message, if that still doesn’t work, then channel, and if that too doesn’t work then persona, and then if all of these still don’t work, then the problem is not with the market but with the product.

What are signs of MMF? Essentially think of it as signals for GRUE: Good Growth with high Retention and strong Unit Economics.

– Monthly double digit growth

– Retention (via SaaS Napkin)

- Churn <3% for enterprise, <7% for midmarket, and <20% for SMB (mostly mortality churn not logo churn)

- Churn <10% for B2C paid users

- Usage (B2C: >50% of customers do a desirable daily action; B2B can be a frequency less than that per the nature of the business)

– Sustainable unit economics (CM2 +ve): Cost of acquiring and serving the customer is less than value of the customer – say LTV CAC 3:1 as a thumbrule (OR) S&M costs as 1/3rd of contribution margin (OR) Sales yield > 1

When MMF is achieved, you hit PMF.

Early PMF looks like a half-prepared but highly used bridge like in this tweet.

Source: X / Twitter

Remember: PrePMF startups are a learning machine, not an earning machine. Don’t scale up revenue by pouring on the marketing $ unless you have achieved MMF and PMF.

IV. The founder’s role during PMF

Let us understand role of the founder at each of these stages – a) product to problem fit b) motion to market fit. The kind of conversation / interaction needed with customer at each of these 2 stages is slightly different.

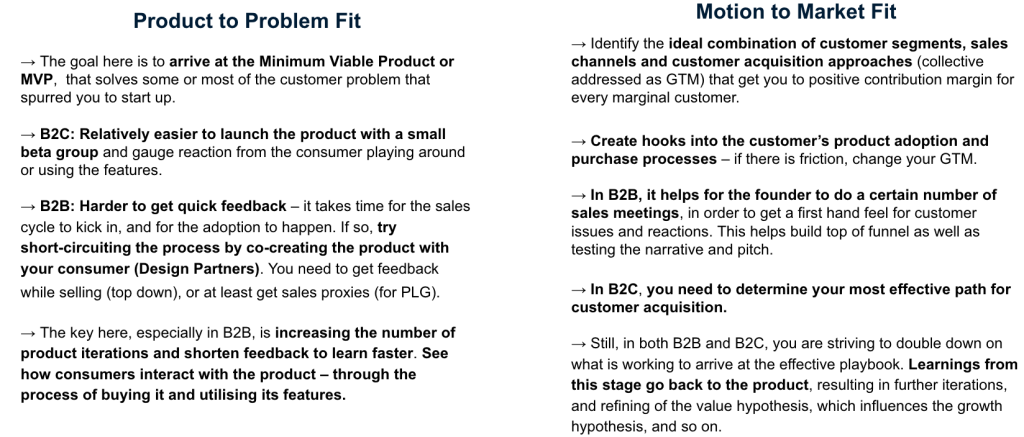

Let us take the first stage of PPF or ‘product to problem fit’, i.e., getting to an MVP. The founder is naturally involved at the preMVP stage – after all s/he is effectively the Product Head then. In the case of B2C products, such as consumer apps, it is relatively easier to launch the product with a small beta group and gauge reaction from the consumer playing around or using the features.

It is harder in B2B to get quick feedback – it takes time for the sales cycle to kick in, and for the adoption to happen. In such contexts, feedback can take a long time. If so, try short-circuiting the process by co-creating the product with your consumer, or give a special offer that makes it irresistible for the consumer to trial the product.

The key here, especially in B2B, is increasing the number of product iterations and feedback to learn faster. Do note that the only way to get effective feedback from the customer, is not by hearing them talk, but seeing how they interact with the product – through the process of buying it and utilising its features. Believe what they do, not what they tell.

For the next stage, MMF, what you are testing is the playbook for GTM + monetisation. At this stage the founder is checking to see if the approach adopted to take the product to the customer is the most efficient approach, i.e., is the energy expended to transfer a rupee from the consumer’s wallet to yours, the lowest possible?

This is important because you are seeing whether the product you have created hooks as frictionlessly as possible into the customer’s product adoption and purchase processes – if there is friction, you need to change your GTM approach, e.g., in B2B, you are determining the optimal channel (partnerships or performance marketing / above the line or content marketing) to build top of funnel as well as testing the narrative and pitch. It helps in this case for the founder to do a certain number of sales meetings, in order to get a first hand feel for customer issues and reactions.

In B2C it means you are determining what your most effective path for customer acquisition is – performance market or virality or content. What route gives you the best ROI on your customer acquisition investments? Still, in both cases, B2B and B2C, you are striving to see customer trial, adoption and engagement, and double down on what is working to arrive at the effective playbook. Almost always, the learnings from this stage go back to the product, resulting in further product iterations, and refining of the value hypothesis, which later influences the growth hypothesis, and so on.

V. Additional (incomplete) thoughts on PMF

PMF is not a one-and-done thing. PMF can come and go (ask Paytm’s Wallet team or the Clubhouse guys). At every stage of growth, your quality of PM Fit can change / weaken. You will then need to adjust your messaging, channel, product and persona selection and configuration to adjust for this.

PMF is a grind. Occasional examples of ‘lighting in a bottle’ examples like twitter aside, most PMF achievements are a steady, slow grind. It is a lot of fiddling with the dials till you hit high fidelity, by continuously iterating on the GTM elements. You then need to ensure the product is relevant and updated to every new customer set that you cater to.

Above slides from my PMF Primer. You can access it here https://bit.ly/pmfprimer

You can also check out a video of a talk (part of their Masterclass series) I gave to the Antler India Residency founder cohort in September 2024. It is called ‘How to achieve Product Market Fit?‘.

If you aren’t a subscriber, feel free to subscribe or follow me at x.com/sajithpai or linkedin.com/in/sajithpai, or check out my substack at sajithpai.substack.com. Product Market Fit is a key topic of obsession for me, and is a topic, I write continuously on.

November 30, 2024 @ 6:27 pm

Dear Sajith,

Just read wonderful and amazingly helpful article “A busy founder’s guide to PMF”. It solves, at least directionally, a very big question for founders when the product is still under construction and untested, as it is in my case. Loved reading it.

Just a feedback- I think there is a type in the para on Sean Ellis test. I think it should state “if more than 40% or more DO NOT reply ‘very disappointed’ to your question on…….then you haven’t hit PMF”

Would be immensely grateful if you can correct my understanding, if there is something I missed.

PS: Request if you can please accept my invite to connect on linked in as well.

Your avid reader,

Prashant.

November 30, 2024 @ 7:31 pm

This is correct, Prashant. I have edited it to reflect the correct explanation. Thank you for pointing out the error.

Thank you for being an avid reader!

Now re Linkedin – I have this rule about keeping LinkedIn connections restricted to folks I have met or videocalled with:)

November 30, 2024 @ 9:53 pm

Thanks for the quick response and being transparent with your Linkedin policy. Hope to meet or video call with you soon 🙂

January 22, 2025 @ 11:37 am

Hi Sajith,

I’m an early career professional who just happened to break into VC and I refer to a lot of your material to understand the various aspects of building and running a startup. I’m in awe, always, of your knowledge, articulation and hold on the subject.

Also read somewhere that you’re writing a book on PMF. Can’t wait to get my hands on it!!

March 9, 2025 @ 8:33 am

Thank you TC for the kind words! Happy to know it is useful!

March 12, 2025 @ 10:02 am

When you said understand pain or problem and then built an MVP fast, I am curious what is this definition of “fast”. How do we set up this metric, that when we iterate how fast is a fast and what expectation shall we have in being fast.

March 23, 2025 @ 5:40 pm

I can understand. ‘Fast’ is a bit vague. It can be anywhere from 2 weeks to 2 months, depending on the features and resources available. AI tools can help speed this a bit more.