Thoughts and reflections inspired by the frenzied pace of investing and dealmaking we are seeing in the early stage in India, and specifically the trend of traditionally later stage investors playing early.

Two, or maybe three types of capital

All money in venture capital is not similar. We can distinguish between

- Nailing Capital: money required to get you to nail your product proposition + GTM (Go To Market) approach and thus arrive at PMF or product market fit – the point where you can see a scalable monetization strategy, i.e., $1 invested in your growth machine cranks out > 1$. This is the territory of seed / preSeries A and some of the Series A capital.

- Scaling Capital: money required to crank up your growth machine + spin the flywheel faster. This is growth capital – Series B and upwards. Here, I like to distinguish between say value-additive growth capital (Bessemer, Norwest etc) and pure velocity capital (e.g., Tiger)

In both cases, the term capital is not restricted to money alone but also the accompanying services and support (setting up metrics, reviews + brainstorming, warm introductions, recruitment and fundraising help)

Historically we saw clear niches for each of the forms of capital

- Nailing Capital – come in early, typically when startup is 3-20 folks large, help them get to PMF and Series A / B

- Scaling Capital (value-added growth) – come in at Series A / B onwards once PMF is achieved, help formalize systems / processes in co, help startup deal with growth pangs and get startup ready for global forays, expansion etc.

- Scaling Capital (velocity) – provide money for unbridled growth & expansion, and often get the startup ready to go IPO / exit.

More and more money coming into early stage startups, and from Scaling Capital

We live in extraordinary times though. Capital is plentiful. And because tech / venture-backed companies have been the dominant wealth creators (alongside crypto) in the past few decades, more and more capital is being allocated to venture by Limited Partners. More and more hedge funds and historically public funds are playing in private companies. Typically such funds play later stage but interestingly they are beginning to advance their participation and play in early rounds too. Scaling Capital in now playing in where Nailing Capital played.

What explains these large multistage funds (those who play across seed to late stage) and hedge funds playing early? Clearly the motivation is to get in early and reduce the cost of the stake. The reason they have stayed away traditionally from early stage investing is due to

- access, and the lack of it at the early stage

- the higher risk that early stage sees, and finally

- the tiny cheque sizes that make the investing effort unviable.

There is a key development that makes it possible and viable for traditionally late stage investors to participate early. This is the rise of what I call Fluent Founders.

As the Indian startup system matured, and the first set of companies founded in the 2005-13 era got exits, their founders started up again, and returned to tap new capital, this time as second-time founders. In addition to these second-time founders, we are also seeing CXOs of soonicorns / unicorns, as well as exVCs (typically the younger lot) starting up. These form a category that I call ‘Fluent Founders’ – founders fluent with the conventions of the genre and know how to play the venture-backed startup game well such as regular fundraising, frequent product iteration, scaling fast, go big or go home attitude etc.

The opposite of this are ‘Fresh Founders’, that is, first-time founders who are not as well-versed with venture / startup game rules. That said, there are some founders e.g., Rahul Mathur of BimaPe, who are first time founders actually falling in the fluent founder slot. The Interwebs especially Twitter has democratized information – and what was earlier known only to a very few – is now available for anyone with a passion for this space, some time and an internet connection.

As the number of Fluent Founders have risen, we are seeing a rush of Scaling Capital coming in early into them. For one they are a more visible presence, and access issues dont matter here as such. Then again, not only are startups backed by Fluent Founders less ‘risky’ but the cheque sizes are also larger, making it worth their while. Thus when we talk about Scaling Capital or late stage capital coming in earlier and earlier, it is largely restricted to Fluent or second-time founders, not necessarily across the board.

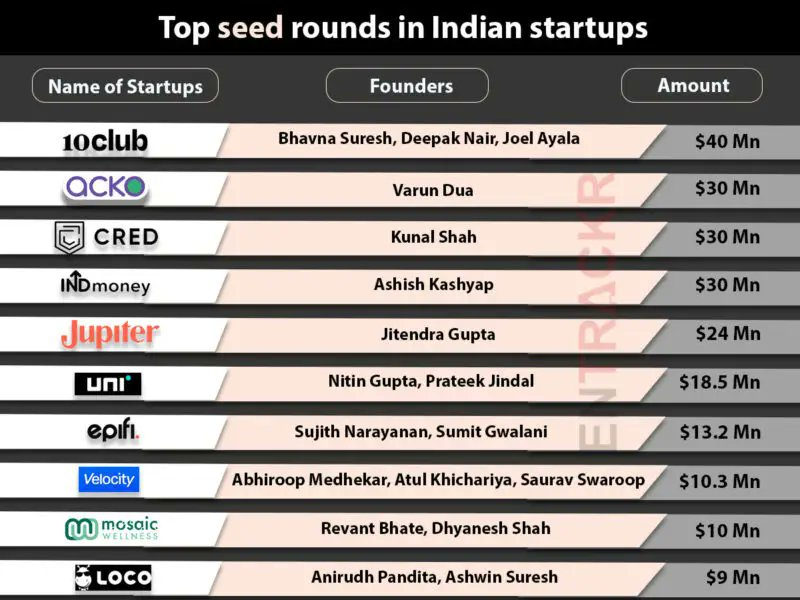

If you look at the largest seed rounds in the Indian startup ecosystem (see chart below; via entrackr.com), then you can see that all of it is aimed at the Fluent Founder set.

For Fluent Founders, access to Scaling Capital providers at this stage has multiple advantages. Instead of tapping seed funds for $1-2m they are getting 5-10x that money from multistage / growth funds. These supersized rounds (which are effectively a Seed + Series A + even Series B combined!) help them accelerate growth faster than the traditional sequential (Seed -> A -> B) fundraising route that Nailing Capital would have enabled. Given their experience, and networks, they also dont need the kind of handholding that Nailing Capital provides.

Don’t take Scaling Capital if you need Nailing Capital

Now if you are a Kunal Shah or Revant Bhate, people who have been part of previous successful startup journeys and know all about building large businesses, it is absolutely fine to take any capital IMO. All other things being equal it is better to take from a multistage fund like Sequoia, Accel or Lightspeed, but it is fine even if it is Tiger or a similar velocity capital purveyor, given that you are a seasoned founder and you dont need the kind of handholding that early stage VCs provide. Capital is fungible for you.

But if you aren’t such a founder then what you need may be Nailing Capital, that which is provided by traditional early stage investors such as seed / pre-Series A / Series A VCs. When I say Nailing Capital I dont mean the money alone but combination of money, time and services that accompany a traditional early stage VC’s investment. Unlike Scaling Capital, early stage VCs are structured to provide time to founders – Investment Leads do between 2-3 new investments a year so that they can provide the time and support that founders need. In addition some of the Seed and Series A VCs have platform teams to provide support services to their portfolio firms such as recruitment, fundraising etc. Either way, capital is not fungible, it is high bandwidth capital laced with distinct value adds unique to each VC firm.

Much more than the services or value adds that Nailing Capital provides, it is the attention and coaching that the VC, specifically the Partner or Investment Lead provides to the founder that is most valuable. The VC may have experience of similar startups or contexts that the new startup investment finds itself in, and may be able to draw from that experience to guide the founder; or it may just be that the VC asks questions, and in attempting to answer those questions, the founder arrives at the solution.

There is considerable tribal knowledge and understanding embedded in early stage VCs that enable founders to build deliberately, and work towards product-market fit. While early stage VCs do want the startup to grow fast, and they do want them to raise another round in 15-18m to validate their growth, there isnt a ‘grow at all costs’ mindset that forces the startup to invest in growth ahead of product-market fit. The focus is on finding the deepest revenue stream not the nearest revenue stream.

Fluent Founders who find themselves recipients of Scaling Capital should be cautious. All may be well so long as the co is doing fine, but when the startup hits a roadblock, founders should understand that Scaling Capital is not designed for patience & handholding at this early stage. Unlike Nailing Capital, which does few deals a year, and can thus take the time out to sit with the founder and help her identify the blockers and remove them, Scaling Capital is not designed for such handholding. There will always be the next shiny startup coming along to excite them.

In the end, every startups becomes what their capital enables them to become.

August 1, 2021 @ 11:54 am

From an quantitative scale, scaling capital has lesser concept risk and more eecution risks and consequently expands ROE and results in a culmination into public capital which often judges businesses based on longevity of ROE and growth – sort of like a seed to sapling, sapling to a tree and tree across cycles. Occassionally a banana tree may come along (remember, all bananas start as trees obviating the seed to sapling risk) that can take on enormous amounts of water right upfront for an accelerated cycle. Hoping a coriander seed can be banana and throwing copious amounts of water isnt a very wise idea