I have been interviewing founders, operators, and investors on their perspectives on product-market fit (PMF hereafter) over the past few months, as part of research for the book I am writing on this topic. I thought it would be a good idea to take stock of the first ten interviews and review the definitions of PMF that have emerged. Thus, this essay where I tease out common strands and themes across their definitions and unpack what they tell us about the topic.

A common theme that has emerged across these conversations, and one that surprised me, is that very few founders think of the startup journey in terms of working towards PMF and after. There is no intentional mindset of “Oh, I am working towards PMF, and this is X, Y, Z, I need to do to achieve PMF.” Instead, founders aim for product love, and then solve for growth and retention, hoping to hit the milestones for the next round of funding. PMF is achieved as a result of the work they undertake to hit the growth and retention metrics. It is useful to think of PMF as an abstraction layer laid above growth and retention.

Nishchay A G of Jar puts it well here – “And to be very honest, we never thought that ki haan product market fit ho gaya kya (Is PMF achieved)? That’s not a question that we ask ourselves. That’s more of a thing that others are defining that apka yeh product market fit ho gaya (you have achieved PMF).We drive numbers and the outcome of that is a product market fit that has happened with us.“

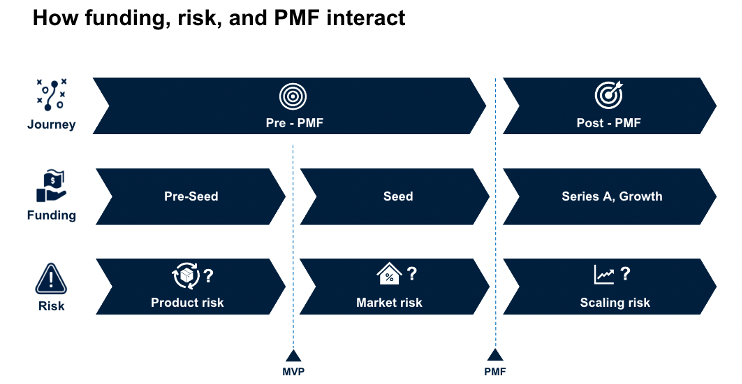

A related strand to the above, is that PMF seems to be a topic that is far dearer to VCs, and one explicitly articulated by them. It is in fact a concept that was invented by VCs or at least first articulated by them (Andy Rachleff / Marc Andreessen) and is a topic that has largely been articulated from a VC’s perspective, though there are exceptions. I don’t think this is entirely surprising, because for VCs, and specifically for Series A VCs, PMF is a gating mechanism to determine if the companies are worth evaluating for funding (as laid out in the below graphic). Hence the VC’s fervent articulation of PMF.

Six types of PMF definitions

The different PMF definitions across the ten interviews coalesce into six broad buckets. I list them one by one. The further down the list, the more unusual the definition.

1. PMF is intense customer love for the product.

Now, I don’t entirely agree with this personally given this excludes the market part of it (i.e., product love scaling to reach the entire market) but I can understand why founders like this. Most founders are drawn to startup to build a great product that solves a deep customer problem, and thereby to have validation of their effort via customer feedback or signals of love, is extremely meaningful for them.

Rajan Bajaj of Slice said “PMF for me is when customers are asked, how disappointed will you be if this product or service doesn’t exist from tomorrow, and they rate the disappointment on a scale of one to 10 as at least 8 on 10. You want to be closer to 10 on 10, but at least 8 on 10 is somewhere you found PMF…if I’m very disappointed that the product is out of the market, I would give 10 on 10 and would be screaming, shouting, unhappy trying to grab it if someone is taking it away from my hand. That’s product market fit.”

Vasanth Kamath of smallcase: “I honestly think, it might not be the business definition….I just think like if there are people who are avid lovers of your product, you have hit PMF. Like who love the experience, swear by it, now the scale of it depends on how large your business is going to be. But PMF is when people love your product, not just use it because they have to or just like it.

2. PMF is like love. You know it when you feel it.

This is the most common definition of PMF that you hear from founders, that it is hard to define, but you will know it when you have it! A bit like Justice Potter Stewart’s definition of porn – “I know it when I see it.” It is also what was mentioned in the original Marc Andreessen PMF piece – “You can always feel product/market fit when it is happening.”

Sheel Mohnot, Better Tomorrow Ventures: “I think it’s one of those things that’s like what is love? You know when you’re in love.

Anshuman Bapna, Terra: “The qualitative part of it almost sounds like the way you describe love, right? Which is, I can’t tell you what it means to be in love. But when you’re in love, you’ll know it. So that’s kind of the completely over a beer kind of a version of PMF.”

Pulkit Agrawal, Chameleon: “PMF is something that every founder thinks about. I think I ended up having much more of a touchy-feely definition of PMF than a robust scientific definition, which is like, do I feel it? I think it’s a combination of, like, are we winning, are customers happy using the product? Is the system working for us to take the product to market?”

3. PMF is pull or effortless sales.

This is the next most common definitions of PMF that I usually encounter in the wild, in articles, in podcasts, in conversations etc. PMF is when push (and effort) shifts to pull from the customer end (inbounds, referrals etc.) and near effortless sales.

Konark Singhal, Mountblue: “…it’s really about effortless sales. I would almost say if a sale is effortless, and you’re almost throttling it, because you can’t service it, I think it’s a probably a good empirical way to say you have a certain PMF. “

Sheel Mohnot, Better Tomorrow Ventures: “I think for product market fit there are signs that you have it. You can say it’s basically a strong pull from the market.”

4. PMF is when you have a sustainable, profitable business.

Profitability is an interesting but relevant qualifier for PMF, for it shows that customers are willing to part with their hard-earney money for the product you are selling, as it is solving their pain. That said, it doesn’t specify the scale or growth of the business and hence can be misleading.

Chaitanya Ramalingegowda of Wakefit: “So, when we started about 6 months later, my third startup, his second startup, Wakefit, we said “Screw everything. No Paul Graham, no YC, no Lean Startup.” We will, first of all, survive as a company….PMF for us meant that we could run the business in a sustainable manner, and unlike a tech business where it is a winner take all, in our industry it is not… And we always, always make money on the first transaction itself. So, for us that became the definition of PMF. “

Prashant Singh, the product czar at fintech app Jar said: “The way I think of product-market fit is an event where a product, a service or a company stumbled upon a solution, which serves the articulated or unarticulated needs of a consumer…. Sometimes people confuse it with scaling. Scaling is a function of TAM and everything else but product market fit – it is a solution made for unserved needs. When you apply it to the startup context, it means that a need is being served and it is also being served in a somewhat profitable way.”

5. PMF as curiosity from the customer’s side, spurring a reaction to the product.

I admit I found this definition highly unusual, but Asad Khan of LambdaTest, who shared it, is a differentiated thinker.

Asad: “PMF for us is that when you give the first cut of the product in hands of the user, the very first PMF is: are they curious about it? The product can never be perfect, but if they have any questions and if they come back to you & ask you to solve something, it means that they did not write off the product;… It’s good for you because when someone is writing you off, they don’t talk, they don’t want to waste their time. If they are talking to you, they’re coming back and spending some money, it means something is working, they like the whole approach of the product….If you are getting feedback, it’s a good sign; it means that the customers are interested in your product even though it is not working perfectly. This is the basic idea of PMF.“

6. PMF is non-linear or sublinear correlation between input and output metrics.

This was another unusual, and a somewhat complex definition. Essentially with PMF, the correlation between input and outputs changes positively. You spend less to acquire similar customer, or the same spend generates better output.

Nishchay A G, Jar: “See, PMF is like an evolution of a system, right? A working system where the output of the system will stop being linear. Meaning say you spent ₹100 and got 100 customers. The moment you say you achieved PMF you will start getting 110 users for the same hundred rupees, and if you spend 110 you get 130 users, and if you spend 130 you will get 200 users. And I mean, I mean this, this can change for every product. For example, for a social it can be something different, for a DropBox kind of a platform, it can be something different.”

Prashant Singh, Jar: “So if I were to put a numerical filter to this, I’ll say there should be a sublinear correlation between two parameters in your business. It can be with every user who comes, the cost of acquiring new users is reduced. So like in a linear correlation, if x increases by delta, the y also increases by delta. In a sublinear correlation, if x increases by delta, y increases by less than the delta. Let’s say my cost of acquiring customers has gone down, which is a good thing. In the same way, if I’m DropBox, with every customer I acquire, my cost of servicing a customer also goes down because I can buy bulk storage, negotiate better bandwidth prices, etc. So when a good PMF is there, some parameters are sublinearly correlated.”

Stacked S-curves and feature-level PMF

A point which came up on multiple interviews was that PMF could be achieved but the eventual market could be too small, and how this meant that you would have to push into adjacencies or expand the market. Anshuman Bapna had an evocative phrase – stacked S-curves – to describe the process of expanding PMF across different markets.

Konark: “Now, again, PMF may be in a certain market which might be small. So you know, your PMF may still not be able to make you a big company. So I mean, PMF runs out so yeah. But we have to be conscious of what the limit of the market is. Well, you can hit it very quickly, sometimes.”

Sheel: “But in terms of PMF, I think the other thing to know is there’s not just one PMF. There’s like, you have a market and you find a product that fits that market niche, but that market might be too small so you have to expand from there. And so, in the case of Thistle, we start out selling juices and delivering juices. Very small market, but people really liked it. And then we expanded into vegan meals and vegan meal delivery ….eventually we added animal protein options and then expanded the market again and then it became healthy meals on delivery. So there’s a few different markets that we sort of search for product market fit within.”

Anshuman: “About 50 to 60% of all people coming to our programs come from referrals, and the kind of keyword or words that they use to describe the experience at Terra is outstanding. Now, the challenge with that, is that why that is still not product market fit is because all that we have proven is that for a very small micro segment of the market, we are golden. But PMF, the M part is obviously as important. And what we have to prove now is that this market is large enough. So in that, and another way to look at is these the classic S-Curves, right? PMF is not one S-Curve, it’s S-Curves stacked on top of each other. And to me, therefore it feels like maybe what you’ve done is that you’ve done one of those S-Curves. But you need to find our next S-Curve, or we don’t have a company, or we have a company which is not interesting enough, large enough, impactful enough and so on.”

Another interesting point in this vein was how Asad and Nishchay referred to PMF as a feature-level event, not just at the product level.

Nishchay: “Again, we don’t try to define a product market fit at a product level, the entire product level. For me, we need to achieve PMF at every feature level. We see PMF at each feature level. We see PMF at our basic offering, which is roundups.”

Asad: “A Bay Area VC told us that 65,000 signups and $250,000 revenue & 100plus customers are the benchmark metrics for PMF. But as a founder I don’t believe in this alone. I have a grocery store & only wheat sale happens. There is everything in the grocery store but people only come for wheat. If so the grocery store is not a PMF, wheat is the PMF. So, the founder has to understand how many features of the product actually truly got the PMF.”

Prashant: “This is a very wrong notion that a company attains product market fit. A use case attains PMF, the company never does. Most likely the company will fuck up the product-market fit. Like short-form video, like UPI, they have attained PMF. If the Paytm server is down, users will go and use any other UPI app unless there is a lock-in. Sometimes you make a fintech company, and maybe you get a product market fit in terms of user acquisition through your QR code or selling recharge.”

TLDR

We will wrap this with a brief summary of the key learnings from the essay. There are many definitions of PMF, though it does seem there are a few popular buckets. Essentially it seems PMF is a VC-lens or abstraction layer over growth and retention. Founders think growth and outcomes and work towards it, and very rarely do they intentionally work towards PMF. VCs look at PMF explicitly as a gating device and have brought into founder consciousness. Merely achieving PMF isn’t enough. The founder needs to make sure that the market isn’t too small, and if it is, needs to expand into adjacent markets or verticals, and stack S-curves on top of each other to grow.

May 21, 2023 @ 12:07 pm

Hi Sajith. I see that type 1 and 2 are titled the exact same. Is this a typo, or am I missing something?

Great stuff as usual!

May 21, 2023 @ 1:29 pm

Oops. Corrected! Thanks for this! Much appreciated.